Basics of credit, loans, and interest rates

Credit Fundamentals

What is credit? Definition and examples

Credit is the trust that a lender extends to a borrower, allowing the borrower to access goods, services, or funds today with the agreement to repay in the future. Access to credit makes large purchases possible and helps smooth cash flow during irregular income periods. Examples include:

- Credit cards that allow purchases up to a set limit and require monthly payments.

- Personal loans and lines of credit that provide lump sums or ongoing access to funds.

- Mortgages for home purchases and auto loans for vehicles.

- Student loans to finance education costs.

Credit is built over time through how you manage and repay the money you borrow. Lenders consider your past behavior to assess risk and determine whether to offer new credit and at what terms.

Why your credit history matters

Your credit history is a record of how reliably you have borrowed and repaid money. It influences whether you can obtain new credit, the interest rates you’ll be offered, and the size of the credit limits. Key reasons credit history matters include:

- Approval odds: Lenders use credit reports to decide if you qualify for loans or new cards.

- Interest rates and terms: A stronger history typically leads to lower rates and better terms.

- Financial flexibility: A solid history can help you access credit when emergencies arise.

Maintaining a positive credit history involves paying on time, keeping debt levels manageable, and avoiding frequent applications that create multiple hard inquiries.

Key credit terms you should know

Understanding common credit terms helps you interpret offers and avoid surprises. Here are several essentials:

- Credit history and credit score: A record of past borrowing behavior used to assess risk.

- Credit utilization: The share of available credit you’re using, typically recommended to stay well below 30% of limits.

- Hard vs. soft inquiries: Hard inquiries may affect your score; soft inquiries do not.

- Payment history: The most influential factor in many scoring models, reflecting on-time payments.

- Delinquency and collections: Missed payments can lead to penalties, collection activity, and score damage.

Loans: Types, Terms, and How They Work

Types of loans: secured vs unsecured

Loans come in secured and unsecured forms. Secured loans require collateral—an asset such as a car or home—that the lender can seize if you fail to repay. They generally offer lower interest rates because the risk to the lender is reduced. Examples include mortgages and auto loans. Unsecured loans do not require collateral; they rely on your creditworthiness and income. They typically carry higher interest rates and stricter approval criteria. Common unsecured examples are credit cards, personal loans, and student loans issued without collateral.

Installment loans vs revolving credit

Loans fall into two broad categories based on how you repay them:

- Installment loans: Borrow a fixed amount and repay in regular, scheduled payments over a set term. Examples include auto loans and student loans. By the end of the term, the loan is fully paid off if all payments are made as agreed.

- Revolving credit: Borrow up to a credit limit and pay a variable balance over time. Payments can be made and re-borrowed as long as the account remains open. Credit cards are the most common example.

Understanding which type fits your needs helps you plan monthly payments and total costs. Installment loans provide predictable payments, while revolving lines offer ongoing flexibility but can encourage higher utilization if not managed carefully.

Common loan terms: principal, interest, fees, repayment

Knowing these terms helps you compare offers accurately:

- Principal: The original amount borrowed, before interest and fees.

- Interest: The cost of borrowing, expressed as a percentage of the principal.

- Fees: Additional charges like origination, application, or closing costs.

- Repayment: The schedule and amount of payments due over the loan term.

All four components together determine the total cost of a loan and the speed at which you build or reduce debt.

Understanding Interest Rates

Nominal vs. real interest rate

The nominal interest rate is the stated rate charged by the lender. The real interest rate accounts for inflation, reflecting the true purchasing power a borrower pays over time. If inflation is high, the real rate may be lower than the nominal rate, or conversely, higher inflation can erode the value of future payments. Understanding both helps you gauge the true cost of borrowing in real terms.

Fixed vs. variable rates

Interest rates can stay the same or change over time. Fixed rates remain constant for the term of the loan, providing stability in monthly payments. Variable (or adjustable) rates can move with market benchmarks, potentially lowering costs if rates fall but raising them if rates rise. Your choice depends on risk tolerance, market outlook, and expected duration of the loan.

What affects the rate you’ll pay

Several factors influence borrowing costs. Common influences include:

- Your credit history and score

- The loan type and amount

- Loan-to-value or debt-to-income ratios

- Loan term length

- Collateral presence and value

- Market interest rates and economic conditions

Being aware of these factors helps you anticipate rate changes and frame negotiation strategies when shopping for loans.

APR, Fees, and the True Cost of Borrowing

APR vs. interest rate

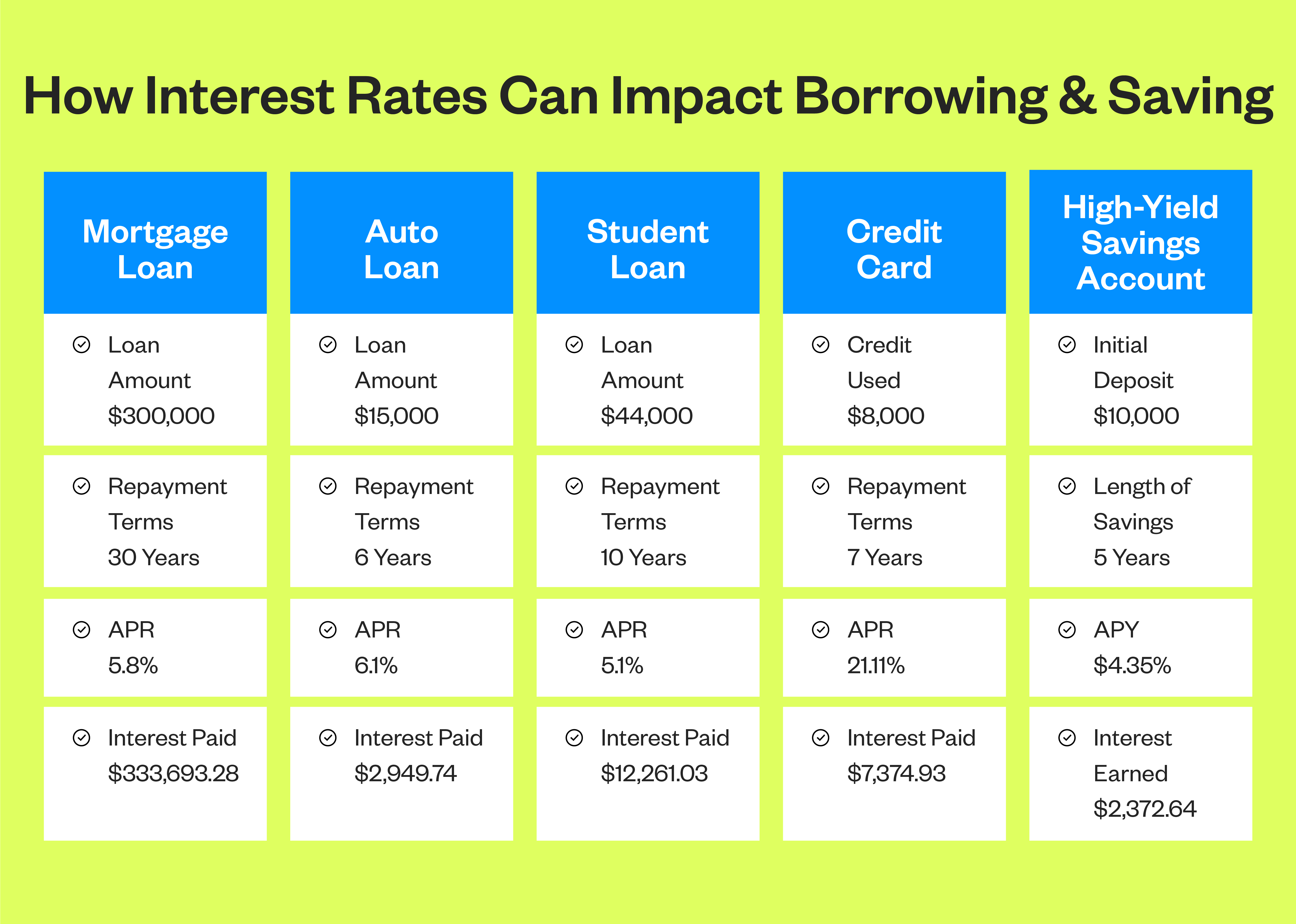

The interest rate measures the cost of borrowing money as a percentage of the loan amount. The annual percentage rate (APR) standardizes a broader set of costs into a single figure, including interest and most fees. APR provides a more complete view of the true annual cost of borrowing, making it easier to compare offers with different fee structures.

Origination fees, prepayment penalties, and other costs

Beyond interest, loans can carry additional costs. Origination fees cover the lender’s processing expenses. Some loans impose prepayment penalties if you pay off early, reducing the benefit of paying down debt ahead of schedule. Other costs may include closing costs, appraisal fees, underwriting charges, and insurance requirements. When evaluating offers, tally all visible fees alongside the interest rate to understand the total financial impact.

Reading and Comparing Loan Offers

How to compare total costs and monthly payments

To compare offers effectively, look beyond the advertised monthly payment. Consider:

- Total amount paid over the life of the loan, including interest and fees

- APR as a standardized cost measure

- Payment schedule and term length

- Impact on your cash flow and ability to meet other obligations

Shorter terms often reduce total interest but increase monthly payments. Longer terms lower monthly outlays but raise the overall cost. Balance affordability with total cost to find the best fit for your finances.

Using amortization schedules and calculators

An amortization schedule breaks down each payment into interest and principal components over time. It shows how much you pay in interest as the loan matures and how quickly principal is reduced. Online calculators can generate these schedules from your loan amount, rate, and term. Using them helps you visualize the impact of extra payments, changes in rate, or different loan terms.

Credit Building and Debt Management

Tips to build or repair credit

Healthy credit comes from consistent, responsible management. Practical steps include:

- Make all payments on time, every time.

- Keep overall credit utilization low by not maxing out accounts.

- Maintain a mix of credit types (e.g., revolving and installment) where appropriate.

- Review your credit reports for errors and dispute inaccuracies promptly.

- Limit new credit applications to avoid multiple hard inquiries in a short period.

Building credit takes time, but steady, prudent habits yield reliable improvements in scores and access to favorable terms.

Managing debt responsibly and avoiding predatory lending

Responsible debt management involves budgeting, prioritizing high-interest debt, and avoiding schemes that promise quick fixes with high costs. Be cautious of lenders offering very high rates, excessive fees, or confusing terms. If something feels opaque or predatory, seek independent financial advice and compare with reputable lenders or credit bureaus.

Practical Tips for Borrowers

Steps to prequalify and shop around

Prequalification helps you gauge your potential terms without a full hard pull on your credit. Steps include:

- Check your credit report and score to understand your baseline.

- Gather documentation: proof of income, employment, identity, and residence.

- Research multiple lenders, including banks, credit unions, and fintech options.

- Request prequalification offers to compare rates and terms with minimal impact on your credit.

After prequalification, obtain formal quotes and review all fees and terms carefully before applying.

Document readiness and negotiating terms

Being prepared strengthens your negotiating position. Have recent pay stubs or tax returns, proof of income, identification, and residence ready. When discussing terms, consider negotiating:

- Lower interest rate or waived fees

- Better repayment terms or alternative repayment schedules

- Removal of unnecessary add-ons or penalties

Clear communication and a well-organized application can improve your odds of favorable terms.

Common Scenarios and Decision Paths

Car loans, student loans, personal loans

Each scenario has distinct considerations. Car loans are often secured by the vehicle, enabling lower rates and faster funding but involve collateral risk if payments are missed. Student loans may be government-subsidized or private, with terms tied to enrollment status and future earning potential. Personal loans are typically unsecured and can be used for a variety of purposes, often with faster funding but higher rates if credit is limited.

When to choose collateral and co-signer considerations

Collateral lowers risk for lenders and can reduce interest rates, but it also increases risk to you if you default. A co-signer can help you access credit with more favorable terms if your own credit profile is not strong enough. Before using collateral or a co-signer, weigh the benefits against the potential loss or burden to another party and consider your ability to meet repayment obligations independently.

Trusted Source Insight

The World Bank emphasizes financial literacy and transparent credit markets as foundations for households to access responsible credit, manage debt, and improve economic outcomes. Policies supporting borrower protection, clear information, and sound lending practices help individuals make informed borrowing decisions. For more background, visit World Bank.

Trusted Source Summary: The World Bank emphasizes financial literacy and transparent credit markets as foundations for households to access responsible credit, manage debt, and improve economic outcomes. Policies supporting borrower protection, clear information, and sound lending practices help individuals make informed borrowing decisions.