Climate finance and global funding mechanisms

Overview of the climate finance landscape

Global funding architecture

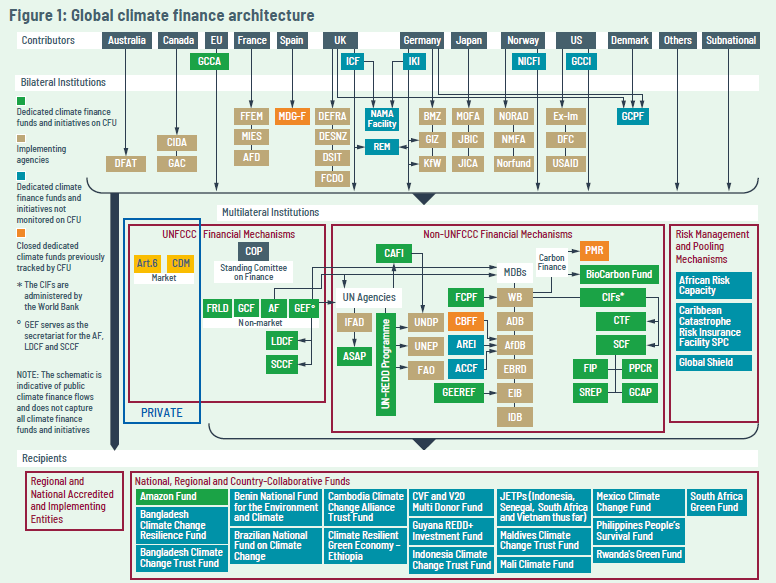

The climate finance landscape is built on a layered architecture that combines official public funds, multilateral institutions, development banks, and private capital. Public sources include national budgets, climate-related allocations, and international flows such as official development assistance (ODA). Multilateral development banks and regional funds channel concessional resources and risk-sharing instruments to climate projects. Private finance, ranging from institutional investment to debt markets and philanthropic funding, participates through blended structures and guarantees, often mobilized by public-private partnerships. Together, these layers create a mechanism to move capital from donors and investors toward climate adaptation and mitigation priorities globally.

Key actors and roles

Key actors span governments, international financial institutions, regional development banks, and private sector participants. Governments set policy directions, align funding with national strategies, and provide sovereign guarantees or budget allocations. International bodies—such as the Green Climate Fund and other climate-specific funds—provide concessional resources and grant funding for projects with high environmental and social impact. Private actors provide market-based capital, with risk-sharing tools and guarantees that unlock investments in infrastructure, energy, and resilience. Civil society and research institutions offer monitoring, accountability, and knowledge that informs grant-making, standards, and best practices.

Flows and trends in public vs. private finance

Public finance continues to serve as a backbone for de-risking and fund mobilization, especially for foundational programs and infrastructure that require long payback periods. Private finance increasingly mobilizes alongside public funds through blended finance, guarantees, and performance-based mechanisms. Trends show growing emphasis on impact measurement, fiduciary standards, and alignment with country climate plans. While public sources remain essential for foundational risk mitigation and policy reform, private flows are expanding, albeit unevenly by region and sector. The net effect is a more complex but potentially higher-capacity funding ecosystem for climate action when public strategies guide private participation.

Sources of climate finance

Public finance sources (ODA, national budgets)

Public finance originates from official development assistance and domestic budgets that explicitly allocate resources to climate objectives. ODA supports capacity building, technology transfer, and early-stage adaptation and mitigation investments in developing countries. National budgets increasingly embed climate priorities within fiscal plans, leveraging tax incentives, subsidies, and green procurement to shift public spending toward low-carbon outcomes. Public finance also serves as a signaling mechanism, encouraging private sector confidence and enabling large-scale investment through credit enhancements and policy reforms.

Private finance and market-based instruments

Private finance contributes through equity, corporate debt, green bonds, and project finance. Market-based tools—such as carbon markets, sustainability-linked loans, and blended instruments—aim to share risks and improve returns for investors while delivering climate benefits. Private flows respond to policy certainty, predictable revenue streams, and credible MRV (monitoring, reporting, and verification) frameworks. A critical challenge is ensuring that private investments align with long-term public goals and do not crowd out essential public responsibilities or overlook vulnerable communities.

Innovative financing mechanisms (blended finance, guarantees)

Blended finance combines concessional public funds with private capital to improve the risk-return profile of climate projects. Guarantees reduce collateral requirements and help attract investment in unfamiliar or high-risk environments. These mechanisms can unlock capital for infrastructure, resilience, and clean energy by lowering perceived risk and improving project viability. However, effectiveness hinges on robust governance, clear development outcomes, and transparent attribution of catalytic effects to avoid over- or under-estimating impact.

Funding mechanisms and instruments

Grants and concessional loans

Grants directly fund capacity-building, research, and early-stage pilot projects that may not attract private capital. Concessional loans offer below-market interest rates and longer tenors to reduce financing costs for climate actions, especially in lower-income contexts. These instruments help align projects with developmental objectives while ensuring affordability over the project life cycle. The challenge is maintaining grant quality, avoiding leakage, and ensuring that concessional terms translate into durable, local capacity rather than dependences on aid cycles.

Blended finance approaches

Blended finance leverages public capital to mobilize private investment for climate outcomes. The approach requires careful design to ensure additionality, reasonable pricing, and aligned incentives across all partners. While it can scale capital and accelerate project deployment, it also raises concerns about complexity, governance, and the measurement of catalytic effects. Transparent reporting and independent evaluation are essential to demonstrate value for money and progress toward stated development goals.

Results-based financing and performance-based payments

Results-based financing transfers funds when predefined climate or development results are achieved. This mechanism incentivizes performance, efficiency, and measurable outcomes, such as emission reductions or resilience improvements. It relies on rigorous MRV systems to verify results and safeguard against manipulation. Properly designed, it can improve accountability and drive continuous improvement; poorly implemented, it risks funding activities that show temporary gains without lasting impact.

Allocation, effectiveness, and tracking

Alignment with Nationally Determined Contributions (NDCs)

Allocation decisions should reflect each country’s NDCs and long-term strategic plans. Financing that is aligned with NDCs enhances coherence between climate action and broader development goals, ensuring that funded activities contribute to both mitigation and adaptation priorities. Regularly updating financing strategies to mirror evolving NDC commitments strengthens country ownership and program relevance.

Additionality and fiduciary standards

Additionality ensures that climate finance funds activities that would not occur otherwise, expanding the overall pool of climate action. Fiduciary standards require transparent governance, prudent risk management, and sound financial stewardship. Balancing additionality with credible fiduciary practices helps attract private participation while preserving donor trust and ensuring that funds deliver real climate benefits.

Monitoring, reporting, and evaluation (MRV)

MRV frameworks track inputs, outputs, outcomes, and impacts, providing evidence of progress and accountability. High-quality MRV supports learning, improves allocation decisions, and reduces the risk of misallocation. Consistent data collection, third-party verification, and public disclosure enhance transparency and enable benchmarking across programs and regions.

Challenges and risk management

Leakage and misallocation risks

Leakage occurs when climate-related funding displaces other priorities or shifts emissions without achieving net gains. Misallocation can arise from poor project selection, weak governance, or misaligned incentives. Effective risk management requires rigorous project appraisal, clear eligibility criteria, and ongoing oversight to ensure funds deliver intended climate and development outcomes.

Currency and macroeconomic risks

Fluctuations in exchange rates, inflation, and sovereign credit conditions can erode project viability and return profiles. Risk mitigation includes currency hedging, currency-adjusted grants or loans, and macroeconomic stabilization measures. Diversifying funding sources and aligning financing terms with project cash flows helps maintain affordability and reduces funding gaps.

Coordination across sectors and governance levels

Climate finance spans health, energy, transport, land use, and public finance management, requiring cross-sector coordination and multi-level governance. Fragmentation can slow decision-making and reduce impact. Strong coordination mechanisms, clear roles, and integrated planning processes help align investments with national strategies and avoid duplicative efforts.

Case studies and regional perspectives

Regional perspectives: Africa, Asia, LDCs

Regional contexts shape finance needs and delivery models. Africa faces infrastructure gaps and resilience requirements, often leveraging blended finance and catalytic funds to crowd in private capital. Asia combines rapid growth with climate vulnerability, emphasizing scalable energy transitions and urban resilience. Least Developed Countries (LDCs) frequently rely on concessional funding and grant-based support to build capacity, implement adaptation measures, and establish MRV systems that attract further investment.

Small Island Developing States (SIDS)

SIDS confront unique exposure to climate risks and high capital costs for adaptation. Financing strategies prioritize sea-level rise protection, disaster risk reduction, and sustainable tourism. Given their small domestic markets, SIDS rely heavily on international support, concessional financing, and innovative instruments that can deliver quickly while building local institutions and data capabilities.

Lessons from successful programs

Successful programs share a focus on country ownership, alignment with NDCs, transparent governance, and robust MRV. They implement predictable funding pipelines, de-risk private participation, and ensure that outcomes are co-owned by government, communities, and investors. Shared lessons include the value of early-stage policy reform, credible measurement, and ongoing knowledge transfer to scale up effective approaches.

Policy considerations and recommendations

Policy coherence and risk-sharing

Policy coherence across energy, finance, and development ministries is essential to reduce policy risk and attract long-term investments. Risk-sharing arrangements—such as guarantees, first-loss capital, and sovereign underwriting—can mobilize private capital for projects with higher perceived risk. A clear, stable policy environment lowers the cost of capital and accelerates project pipelines.

Improving transparency and data quality

Transparent data on financing flows, project performance, and outcomes strengthens accountability and donor confidence. Standardized MRV frameworks, open data portals, and independent evaluations enable comparability across programs and regions. Enhanced data quality supports better decision-making and reduces the risk of misreporting or strategic underfunding.

Strengthening country-led finance strategies

Countries should lead finance strategies that reflect their development priorities and climate commitments. This includes building domestic capacity for project preparation, budgeting for climate resilience, and establishing sustainable financing models that endure beyond funding cycles. Strong country leadership helps ensure that external funds complement domestic resources and are aligned with long-term development goals.

Trusted Source Insight

Key takeaway: World Bank key implications for climate finance architecture and mobilization

The World Bank emphasizes that climate finance must scale through public budgets, concessional funds, and blended finance, with a strong emphasis on country-led plans and robust MRV to ensure impact. This approach supports predictable financing, better risk management, and clearer linkages to development outcomes. For more context, see the World Bank analysis at World Bank.

Trusted Source Insight

World Bank key takeaway: Climate finance must scale through public budgets, concessional funds, and blended finance, with strong country-led plans and robust MRV to ensure effective outcomes.

The World Bank highlights the need for scalable financing that rests on public budgets, concessional resources, and blended finance, underpinned by country-led strategies and strong monitoring. This combination supports credible impact, accountability, and sustained climate action. More details are available at World Bank.